Broadcom (AVGO) Stock Valuation Analysis

Business Introduction

Broadcom is a global leader in providing semi-conductor and foundational infrastructure software solutions. Its business is diversified into two significant segments: semi-conductor solutions and infrastructure software. The semi-conductor solutions encompass a wide range of products, including broadband, network, wireless, storage, and industrial products, primarily serving data centers, communication equipment, and enterprise storage. The infrastructure software business offers solutions for enterprise security, network management, and development operations. This strategic combination allows Broadcom to offer end-to-end technology solutions to its customers, while mitigating operational risk through diversification. Looking at the revenue structure, semi-conductor solutions contribute approximately 70% to total revenues, while software solutions account for about 30%, a structure expected to remain stable in the coming years.

Broadcom's edge

Broadcom's competitive edge stems from multiple dimensions. Technological leadership is a result of substantial research and development investments, consistently allocating 15-20% of annual revenues, projected to reach USD 218 billion by 2025. This significant investment ensures a leading position in key technology areas. The company commands the markets in various segments, such as storage controllers, holding over 65% market share, and network switch chips, with over 50% market share. Its robust patent portfolio, consisting of over 20,000 patents, provides a strong safeguard for product innovation. Deep, high-stickiness relationships with major tech companies strengthen customer loyalty. The fabless manufacturing model, partnering with leading contract manufacturers, balances production capacity with capital expenditures control. These advantages collectively create a formidable moat, making it challenging for competitors to disrupt the company's market position.

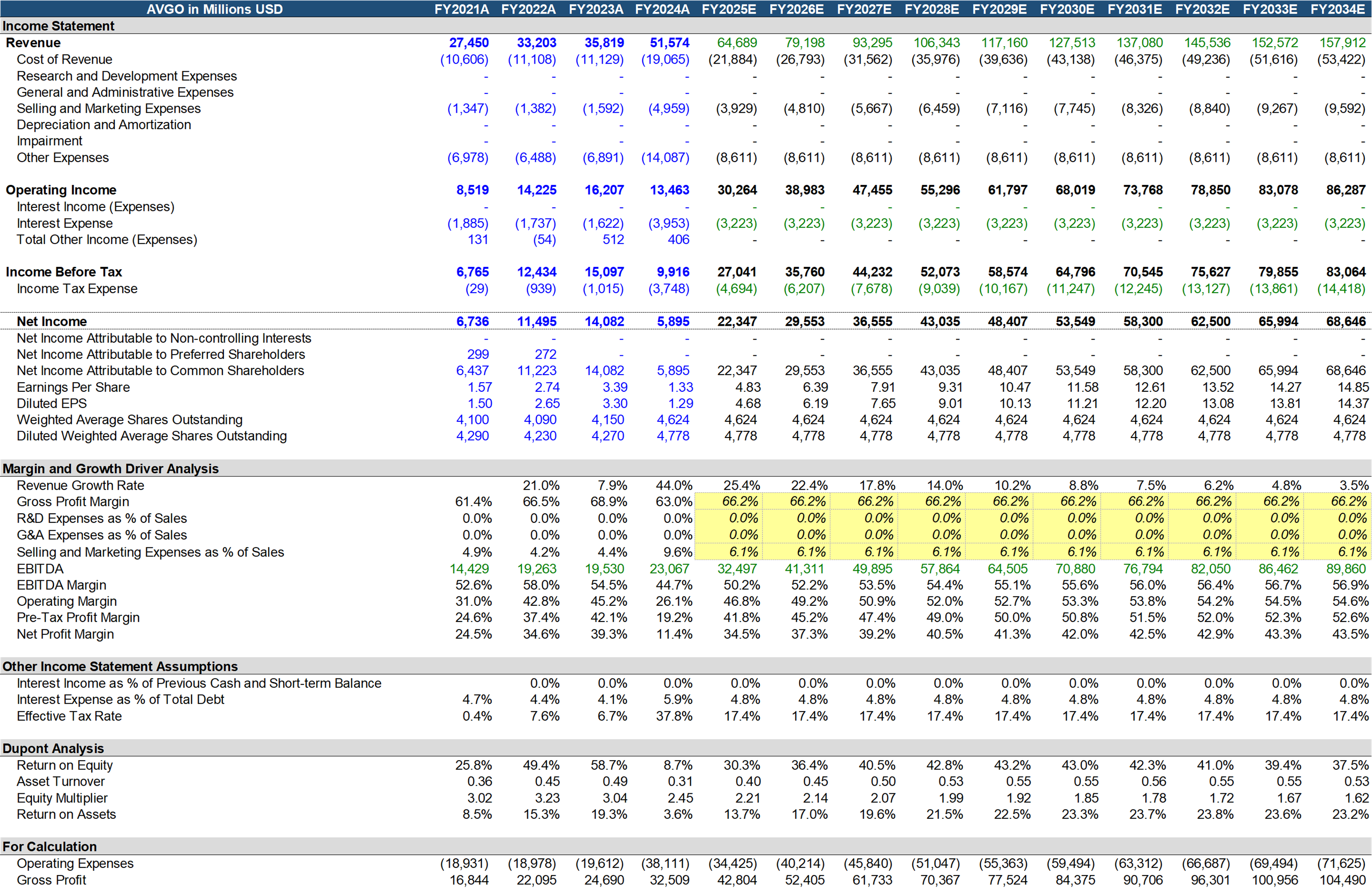

Revenue and Profitability Analysis

The future of Broadcom appears promising, with revenue growth projected to be robust. According to historical data, the company's revenue is expected to surge from USD 274.5 billion in 2027 to USD 515.7 billion by 2024, representing a compound annual growth rate of 23.4%. Moreover, analysts predict a continued strong growth rate of 10-15% from 2025 to 2034, reaching a milestone of USD 1579.1 billion. The key drivers of this growth include increasing demand in data centers, accelerating 5G deployments, and the digital transformation of enterprises.

The company's profitability has seen significant improvement. The gross margin is anticipated to rise from 61.4% in 2027 to 63.0% by 2024, and is expected to stabilize at approximately 66.2%. This reflects enhancements in product portfolio optimization and operational efficiency. Furthermore, the net margin is projected to increase substantially from 11.4% in 2024 to 43.5% by 2034. Per share earnings will also see a substantial rise from USD 4.83 in 2024 to USD 14.85 in 2034.

AVGO’s income statement, generated by FiMo Copilot, in merely seconds.

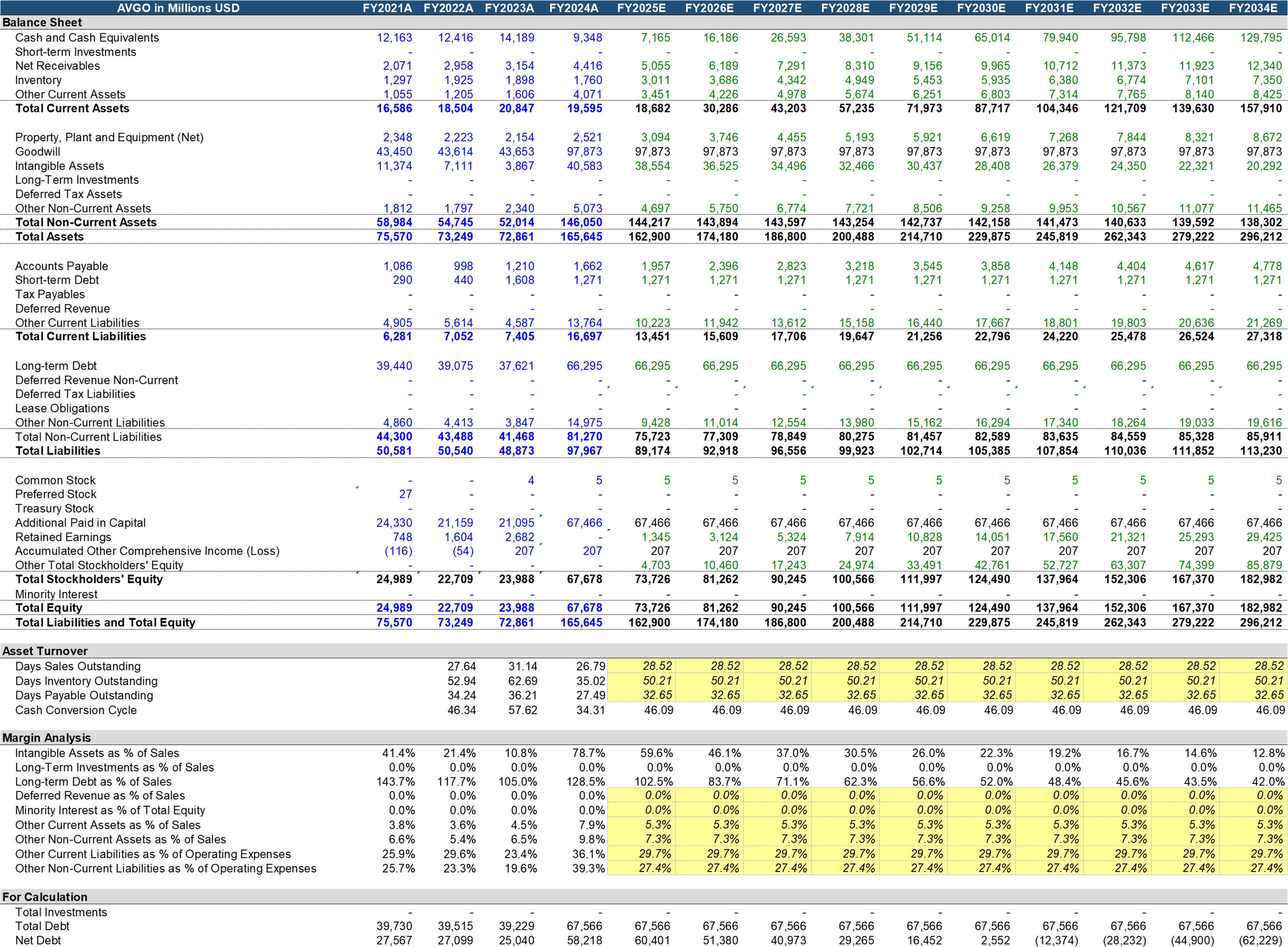

Asset and Liability Analysis

Broadcom's asset quality has consistently improved, marked by a substantial increase in cash and cash equivalents from USD 93.5 billion in 2024 to USD 1,297.9 billion in 2034, representing 43.8% of total assets compared to 5.6% in 2024. The company efficiently managed its working capital, maintaining a healthy days sales outstanding (DSO) of 28-29 days.

The company's asset-light operating model is reflected in a stable capital expenditure of roughly 1.2% of revenue annually. The capital structure is robust, with total assets reaching USD 1,656.5 billion at the end of 2024, of which USD 979.9 billion were liabilities and USD 676.8 billion were stockholders' equity, resulting in an asset liability ratio of 59.2%. The company's debt structure is also well managed, with long-term debt exceeding 80% of total liabilities and most of it being due after 2025, thereby minimizing liquidity risk. The interest coverage ratio, exceeding 10 times, highlights ample capacity to cover debt obligations.

AVGO’s Balance Sheet, generated by FiMo Copilot, in merely seconds.

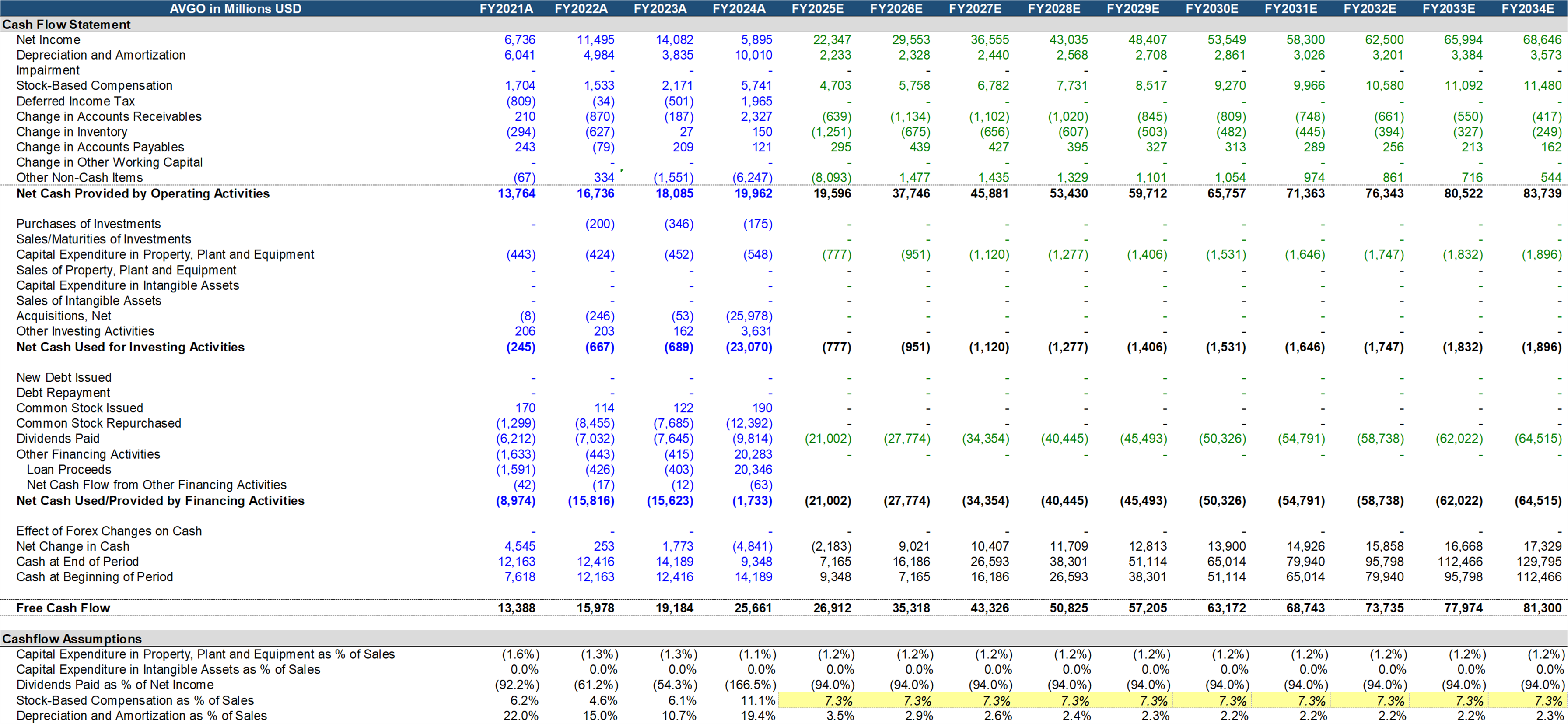

Cashflow Analysis

Broadcom exhibits exceptional asset quality, which has consistently improved over time. The company's cash and cash equivalents have grown significantly from USD 9.35 billion in 2024 to USD 1297.9 billion in 2034, increasing from 5.6% to 43.8% of total assets. The accounts receivable turnover days remain healthy at 28-29 days, indicating robust working capital management. The company's fixed asset investments are stable, with capital expenditures averaging around 1.2% of revenue each year, highlighting the advantages of its asset-light operating model. The capital structure is also robust, with a total asset value of USD 1656.5 billion as of the end of 2024, consisting of $979.9 billion in liabilities and $676.8 billion in owners' equity, resulting in a debt-to-equity ratio of 59.2%. Long-term debt accounts for over 80% of the total liabilities, most of which matures after 2025, thereby limiting liquidity risk. The interest coverage ratio exceeds 10 times, demonstrating ample debt coverage ability.

AVGO’s Cashflow Statement, generated by FiMo Copilot, in merely seconds.

Valuation Result

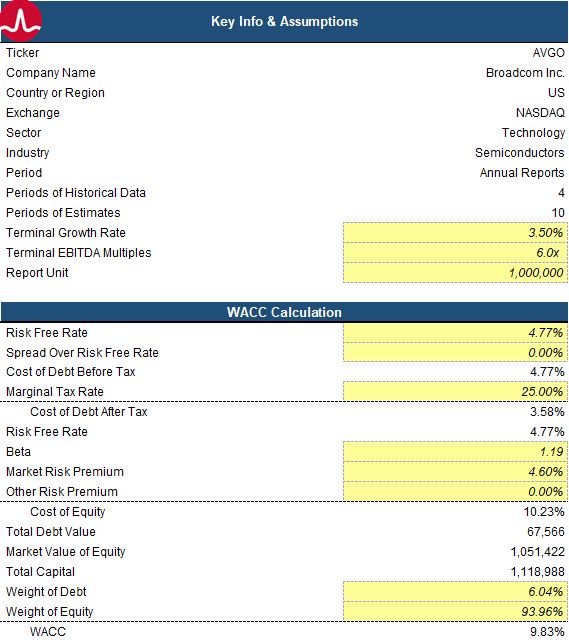

For our analysis, we utilize a risk-free rate of 4.77%, aligned with the 10-year U.S. Treasury Note yield. We incorporate a market risk premium of 4.60%, reflecting the current market's risk environment. Our analysis is based on an effective tax rate of 17.4%, informed by the company's actual tax liabilities. Furthermore, we apply a debt cost of 3.58%, based on the company's current financing costs. The WACC is refined by an unlevered beta of 1.19, ensuring that the firm's business risk profile is adequately accounted for. This robust approach enables us to derive a comprehensive Weighted Average Cost of Capital (WACC) that accurately reflects the company's cost structure and market conditions. Then we come to the WACC of 9.83%.

AVGO’s Discount Rate, generated by FiMo Copilot, in merely seconds.

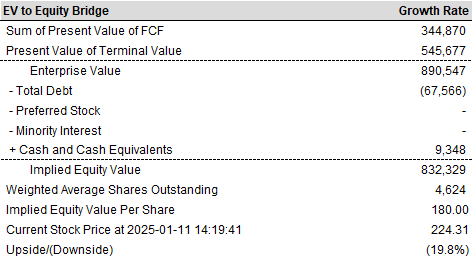

In a recent estimate of our company's overall value, we project a robust figure of approximately $8.9055 trillion, after accounting for our net debt of about $675.7 billion. This yields an impressive equity value of $8.3233 trillion, equivalent to $180.00 per share.

AVGO’s Intrinsic Value, generated by FiMo Copilot, in merely seconds.

However, considering potential optimistic scenarios where our revenue growth rate increases by 2% and our profit margin increases by 1%, our equity value could soar to an estimated $9.5 trillion and a per share value of $205.50.

Conversely, in a more conservative scenario where our revenue growth rate decreases by 2% and our profit margin decreases by 1%, our equity value would still be substantial at $7.5 trillion, corresponding to $162.20 per share. These projections underscore our strong position in the market and our potential for continued growth.

Conclusion

As a veteran leader in both the semiconductor and infrastructure software domains, Broadcom exhibits an exceptional investment proposition. The company holds a dominant position across multiple key market segments, consistently reinforcing its technological superiority with over $20 billion in research and development investment annually. Financially, the company is expected to maintain a stable 10-15% revenue growth, while maintaining industry-leading profitability. Its asset quality is outstanding, boasting a rich cash reserve and a well-structured liability profile, which ensures a steady expansion of operating cash flow.

With a market value that still reflects a 10-15% discount relative to its intrinsic value, Broadcom remains an attractive long-term investment opportunity, driven by its comprehensive competitive advantages in technological innovation, market share, cost control, and long-term growth drivers such as data center, 5G, and enterprise digitization.

Last Modified: January 11, 2025

Keywords: Broadcom, AVGO, semiconductor solutions, infrastructure software, revenue growth, profitability, gross margin, net margin, cashflow, WACC, valuation, market share, R&D investment, competitive advantage, intrinsic value, long-term investment, data center, 5G, enterprise digitization, asset quality, liabilities, equity value.

Disclaimer: This analysis is for informational purposes only. Consult a financial advisor before investing.